Importing Balances

- On the navigation bar, select the Accounting tab and General Ledger menu.

- On the navigation bar, select the Accounting tab and General Ledger menu.

- On this page, to the right, please click the Import CSV button.

- Download the template and then complete your own CSV.

- Import the CSV using the same interface.

- Refer to the template if you receive an error message.

Entering Invoices with Open Balances

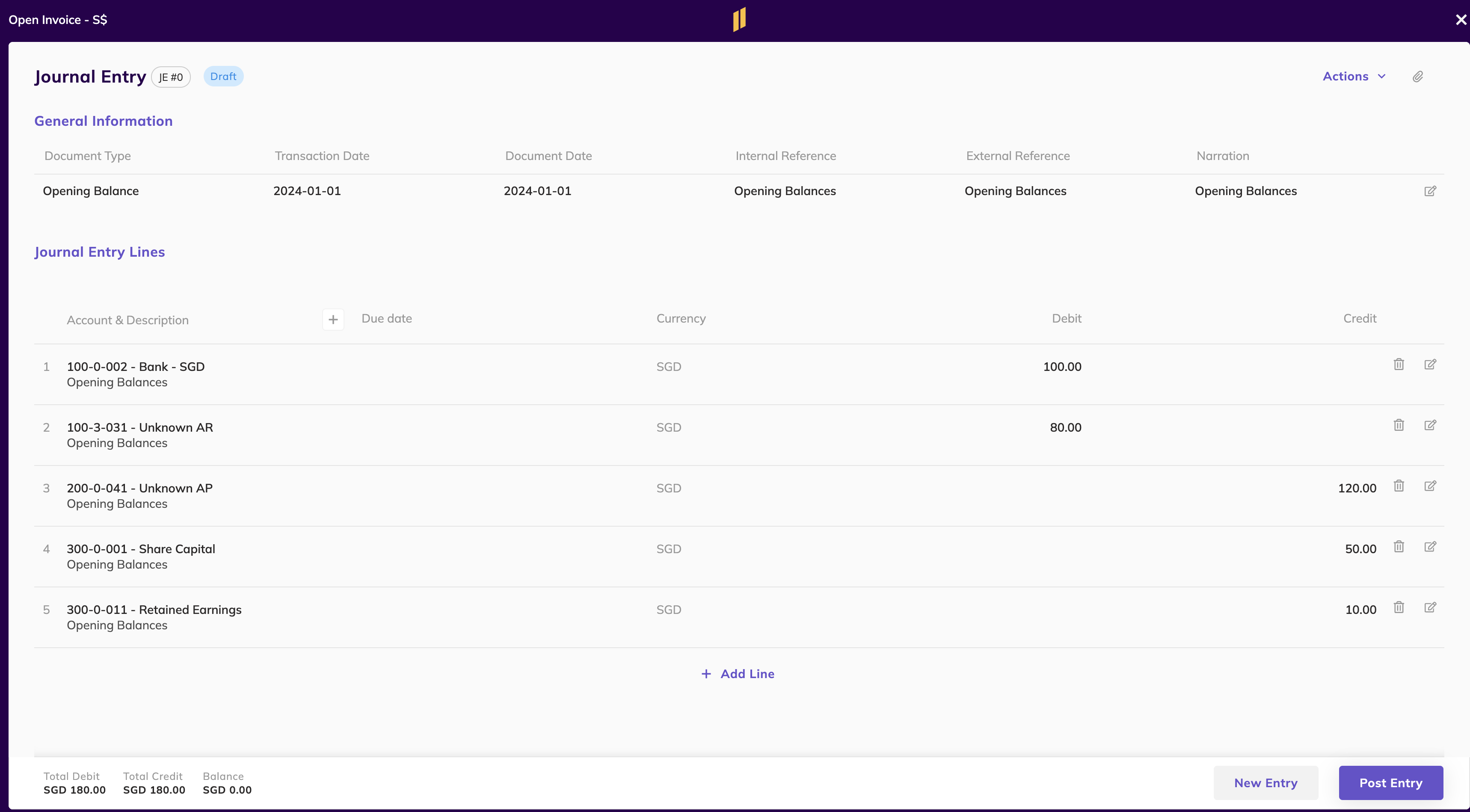

💡 When migrating Open Invoices, user would need to enter the Open Balances for Accounts as an Opening Balance JE and also enter the Open Invoices (both Customer Invoices and Vendor Invoices as Invoices.

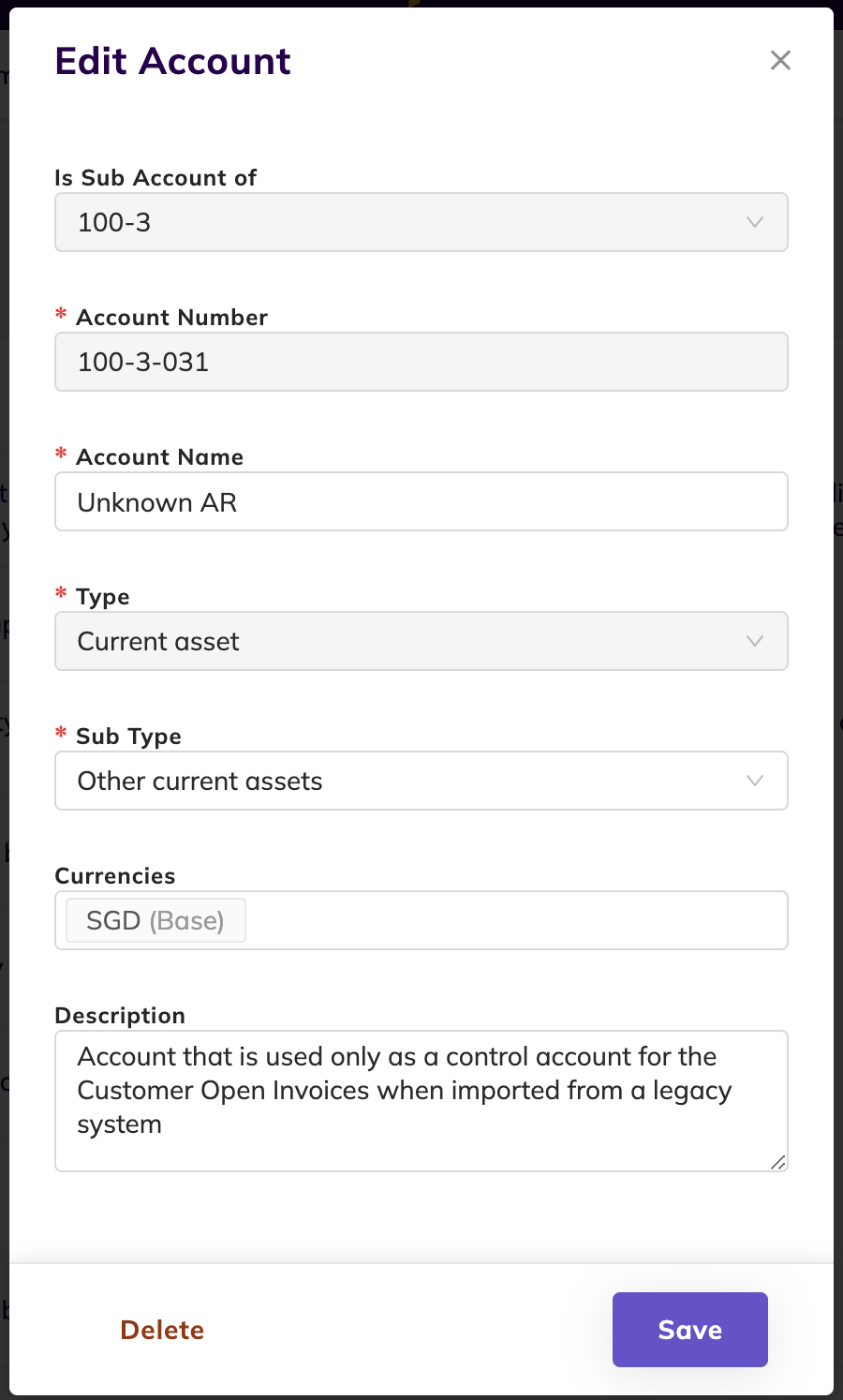

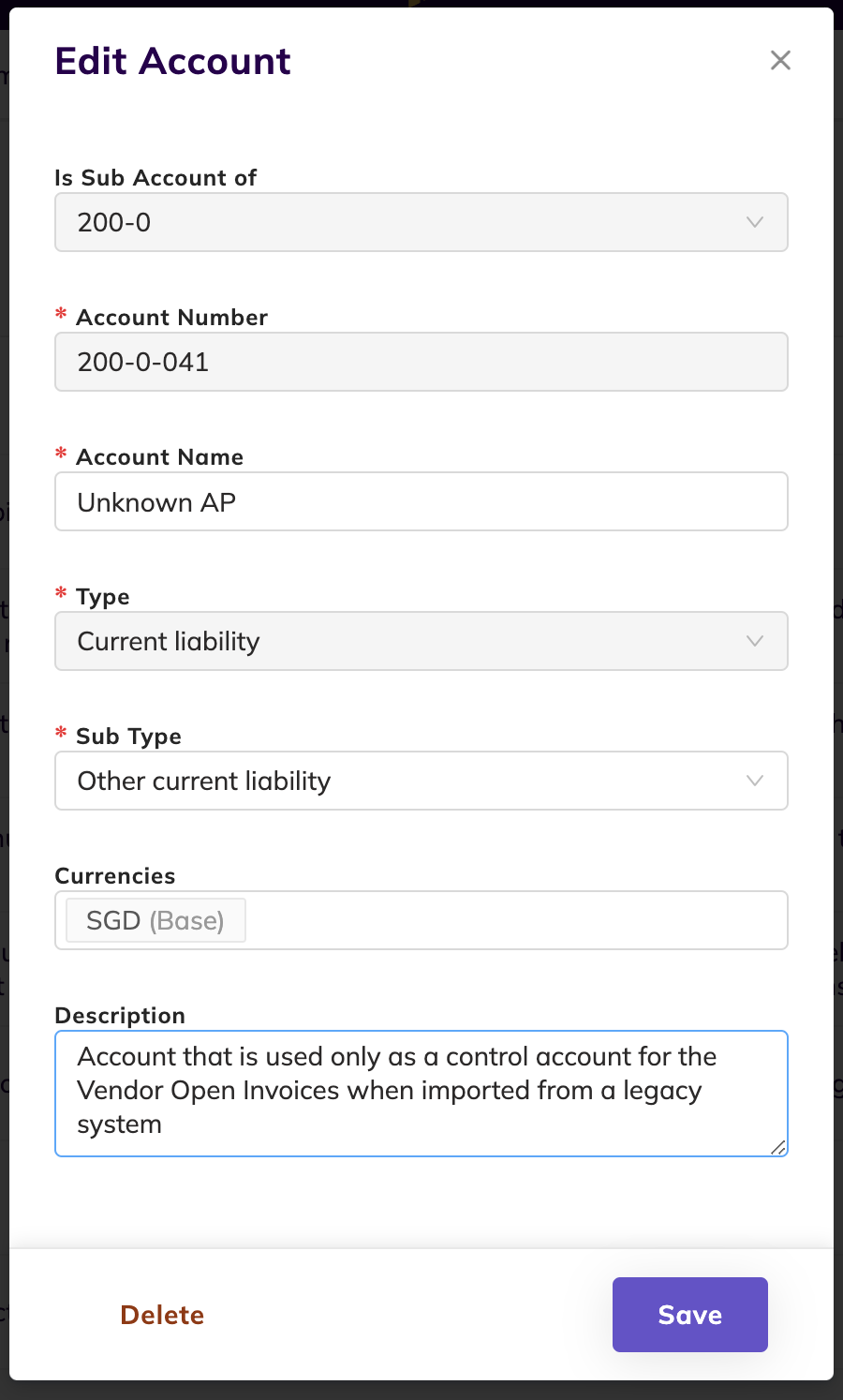

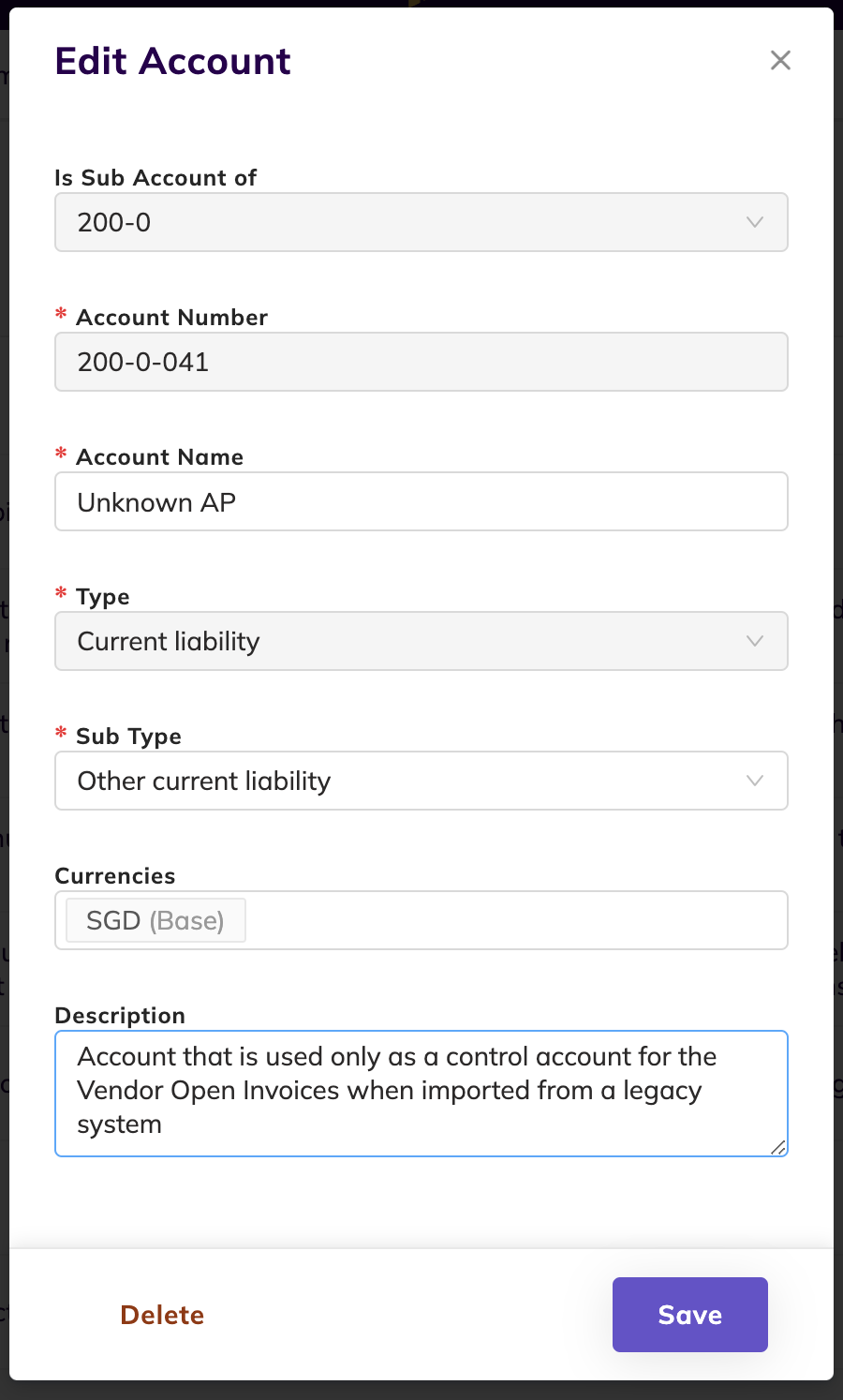

Step 1 : Create Accounts to Hold the Total ARAP Balances

💡 Note : If you have open invoices in multiple currencies, please add those currencies in the list of currencies supported by that account

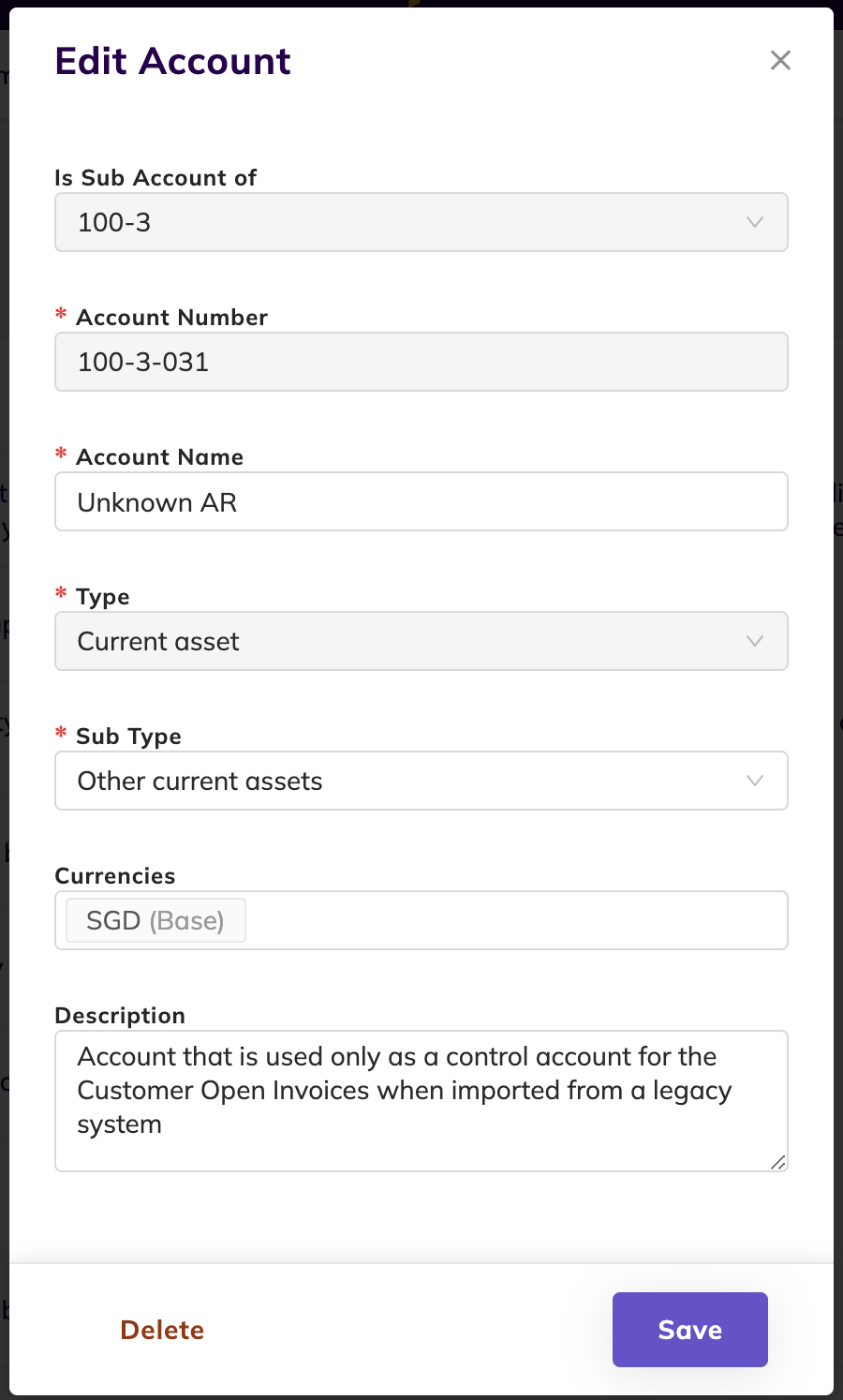

User should create two additional accounts in the COA

- Unknown AR, Current Asset, Other Current Asset

- Unknown AP, Current Liability, Other Current Liability

If you want to import open invoices in FX, just add the currency to the unknown AR and unknown AP account and enter a journal entry line with the amounts in that FX. You should then create open invoices in that FX as well.

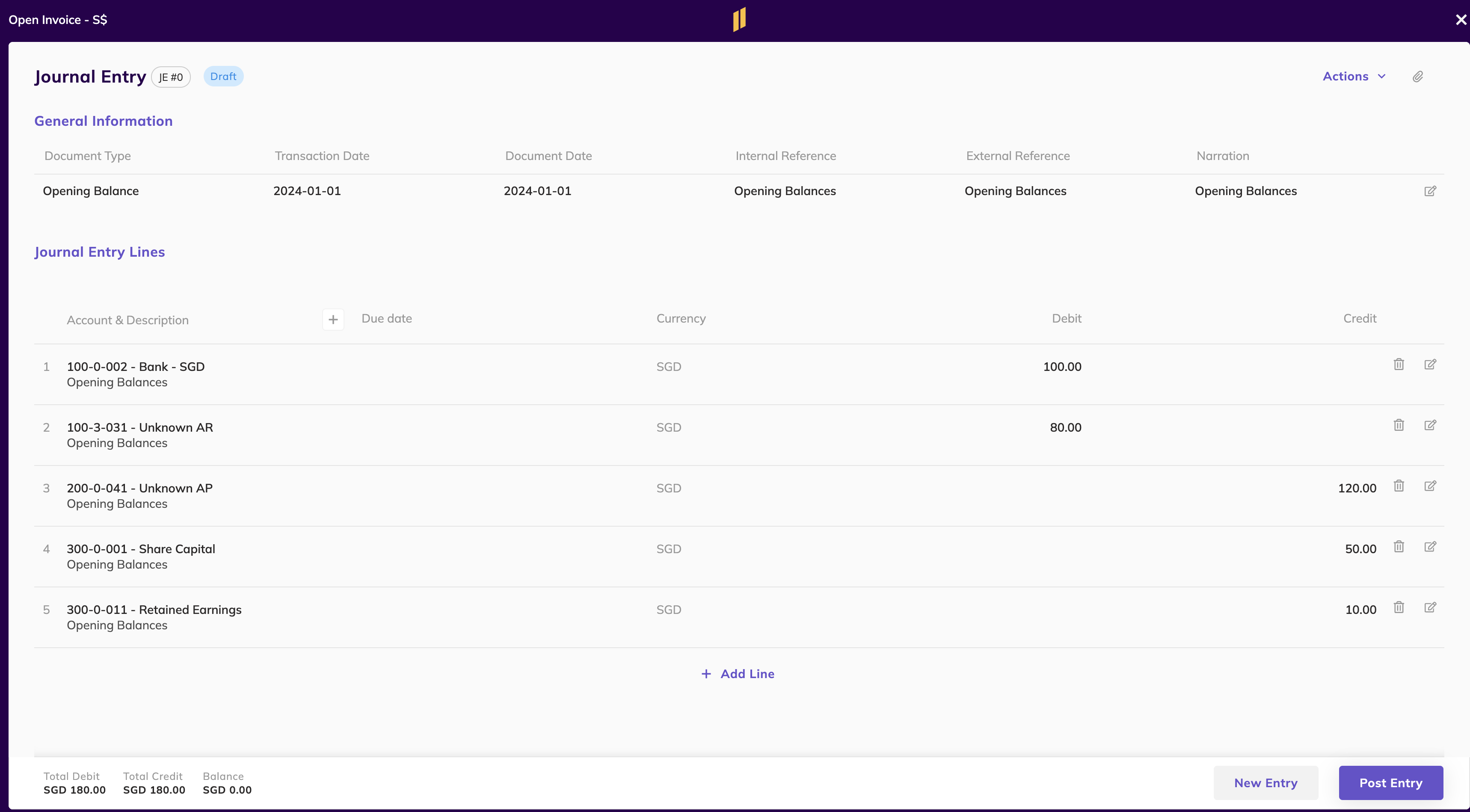

Step 2 : Create Opening Balance Journal Entry

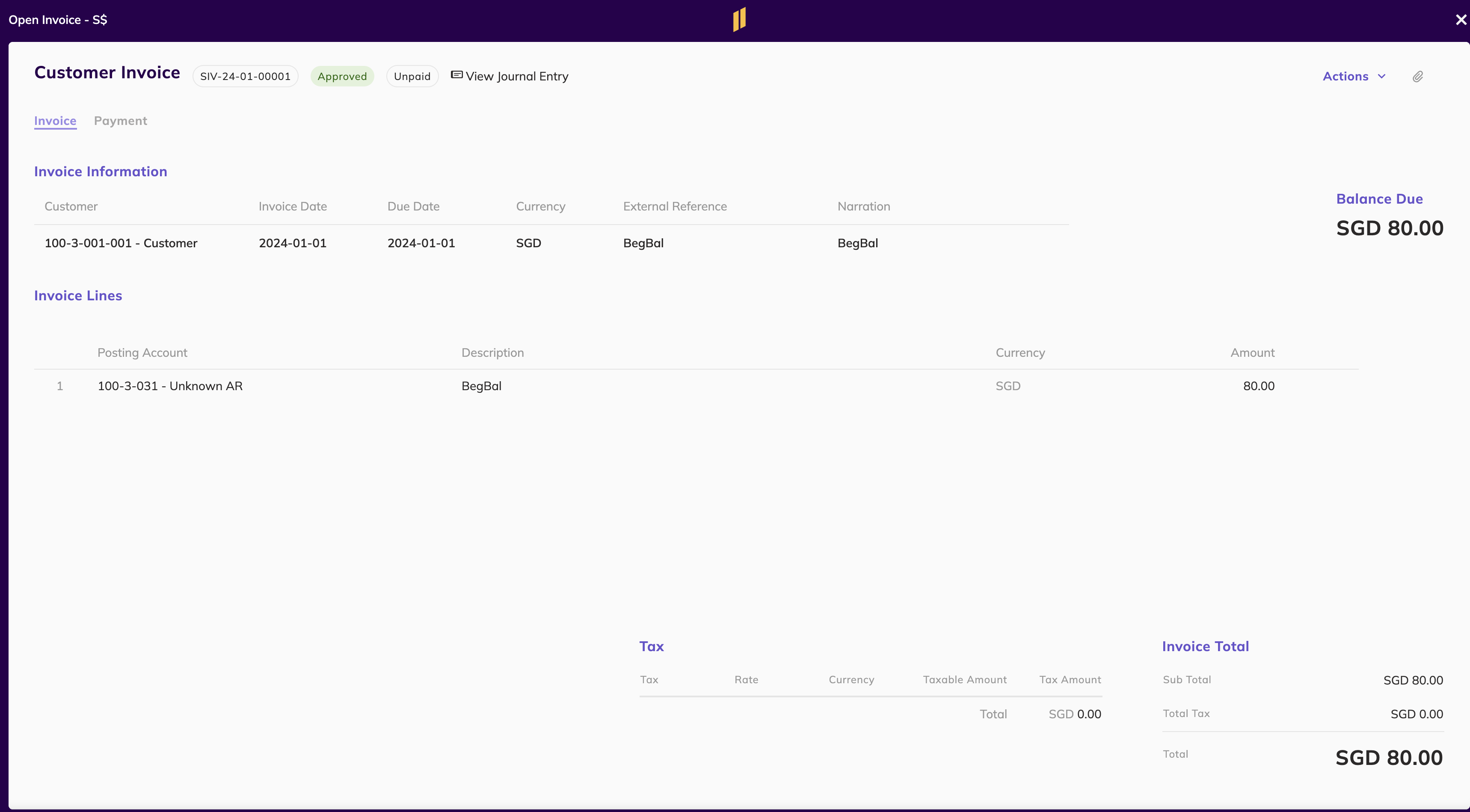

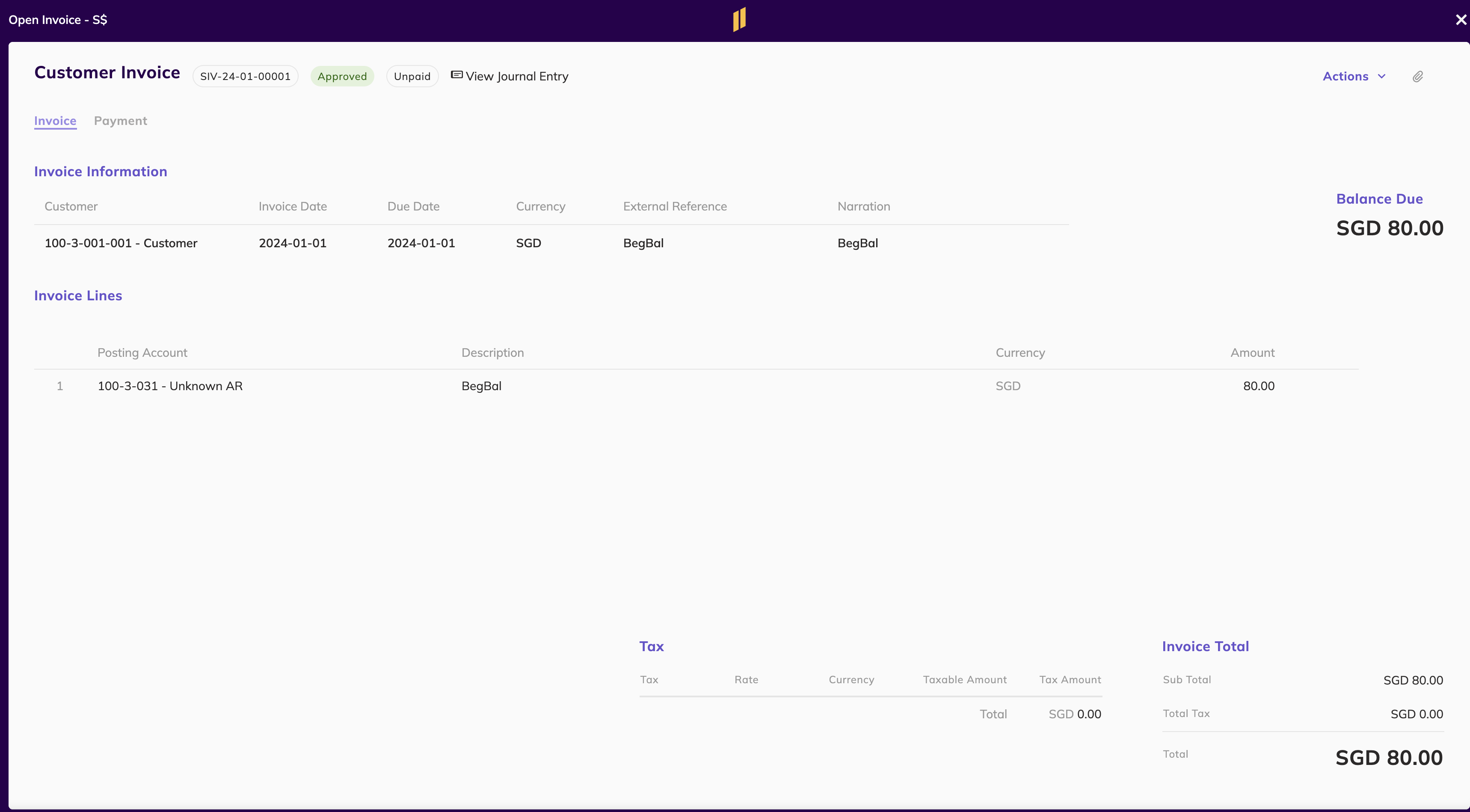

Step 3: Create the Invoice(s):

- Customer / Vendor Name

- Invoice Date: enter the first day of the fiscal year

- Due Date: for invoices that were due before the first day of the fiscal year, enter the first day of the fiscal year, for invoices that were due after the first day of the fiscal year, enter the due date as on the original invoice

- Hearder Narration : enter a label that indicates this invoice is from your legacy system. In this example we use “BegBal”.

- Line Narration: enter a label that indicates this invoice is from your legacy system. In this example we use “BegBal”.

- Posting Account: this will be the account that is debited or credited. Use the account Unknown AR for the Customer open invoices. Use the account Unknown AP for Vendor open invoices.

- Amount: enter the outstanding invoice amount as the amount.

- Taxes: if taxes are to be collected on the open invoices the Company may feel it’s necessary to enter the tax amounts when brining legacy invoices.

Save the invoice as draft

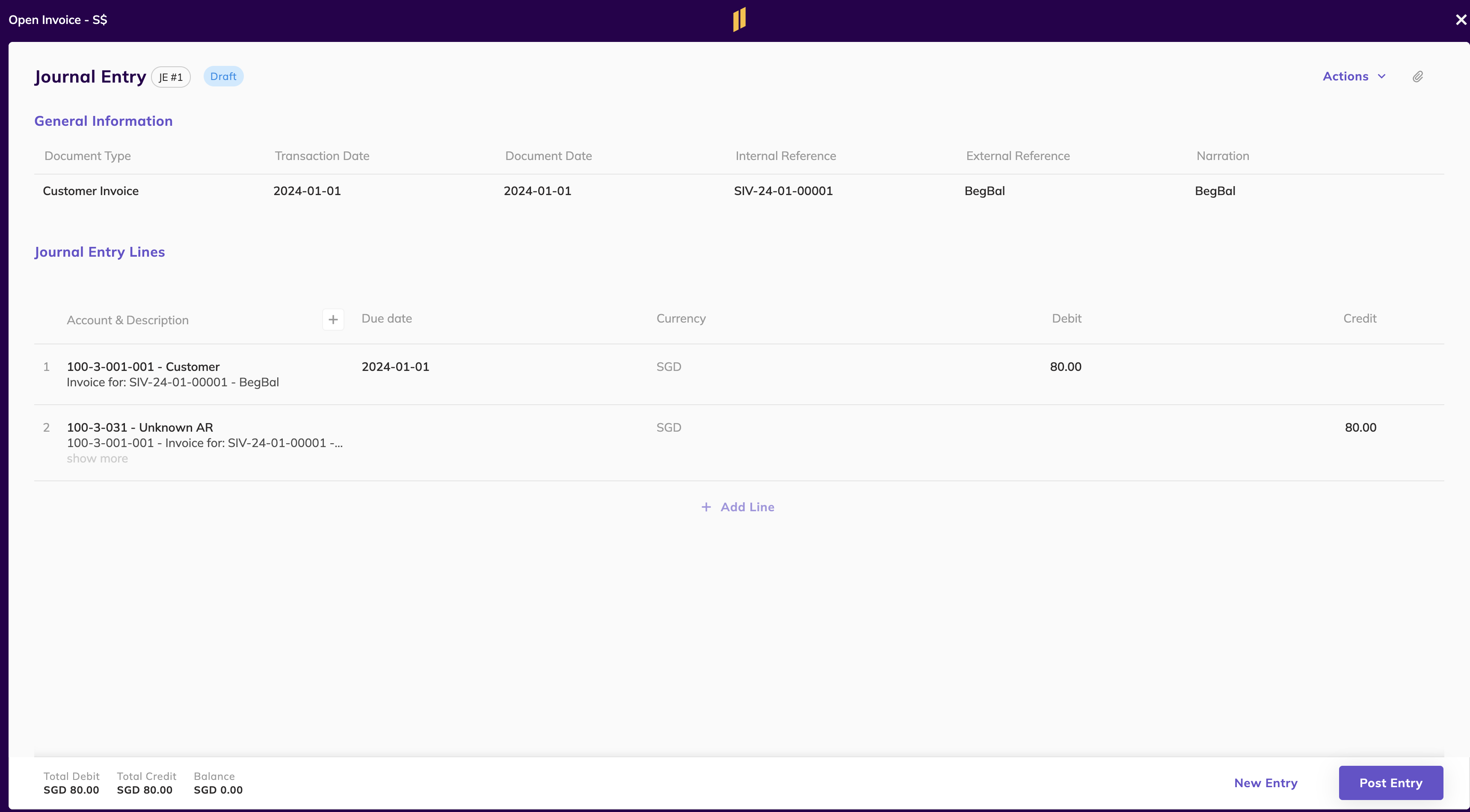

Click on the View Journal Entry badge to ensure the AR/AP Account is correct and see what other accounts will be affected by this entry. If you are comfortable with the accounts affected, you can approve the invoice.

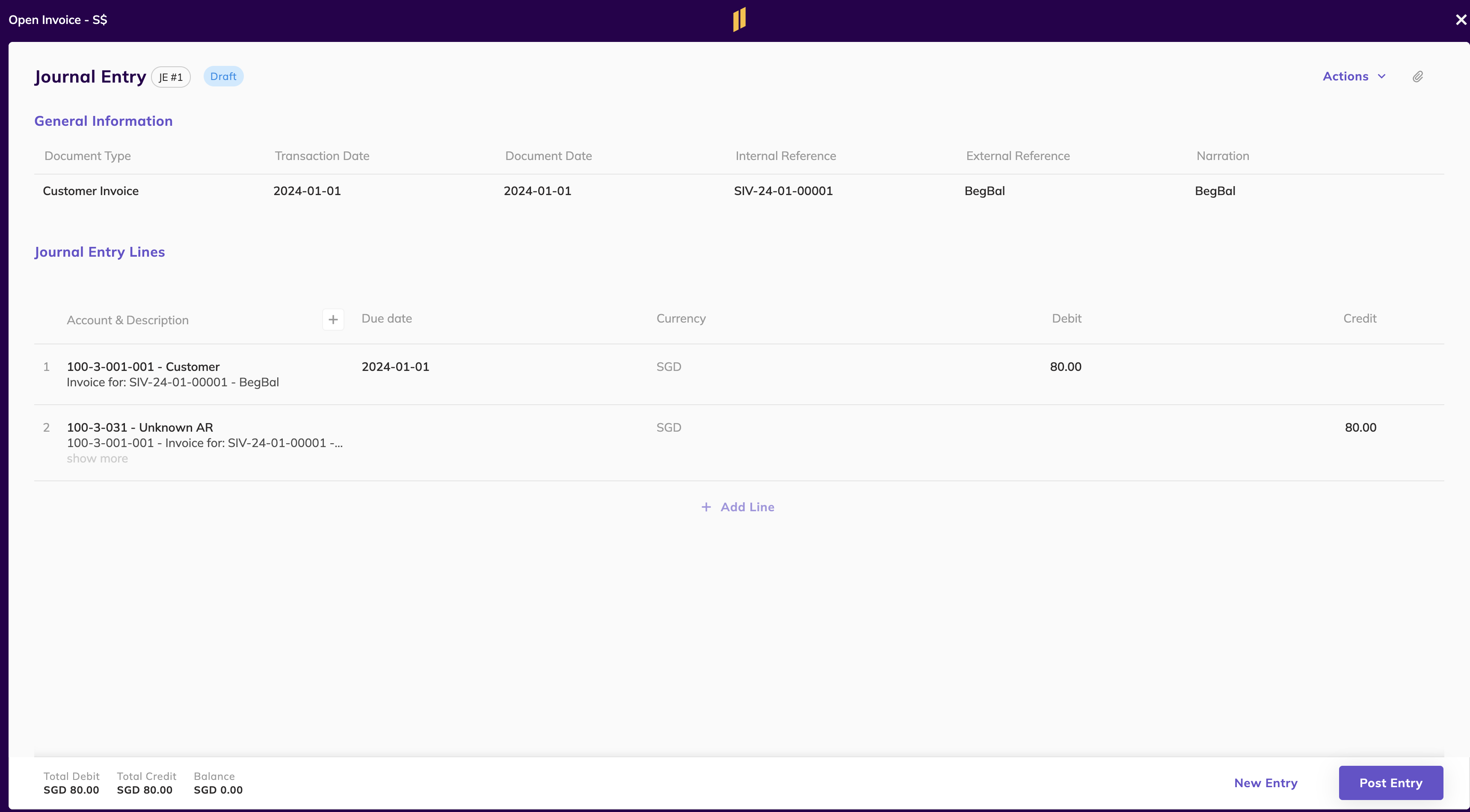

Here is a sample of how the Invoice would look like for an Open Customer Invoice

Here is what the JE would look like upon posting

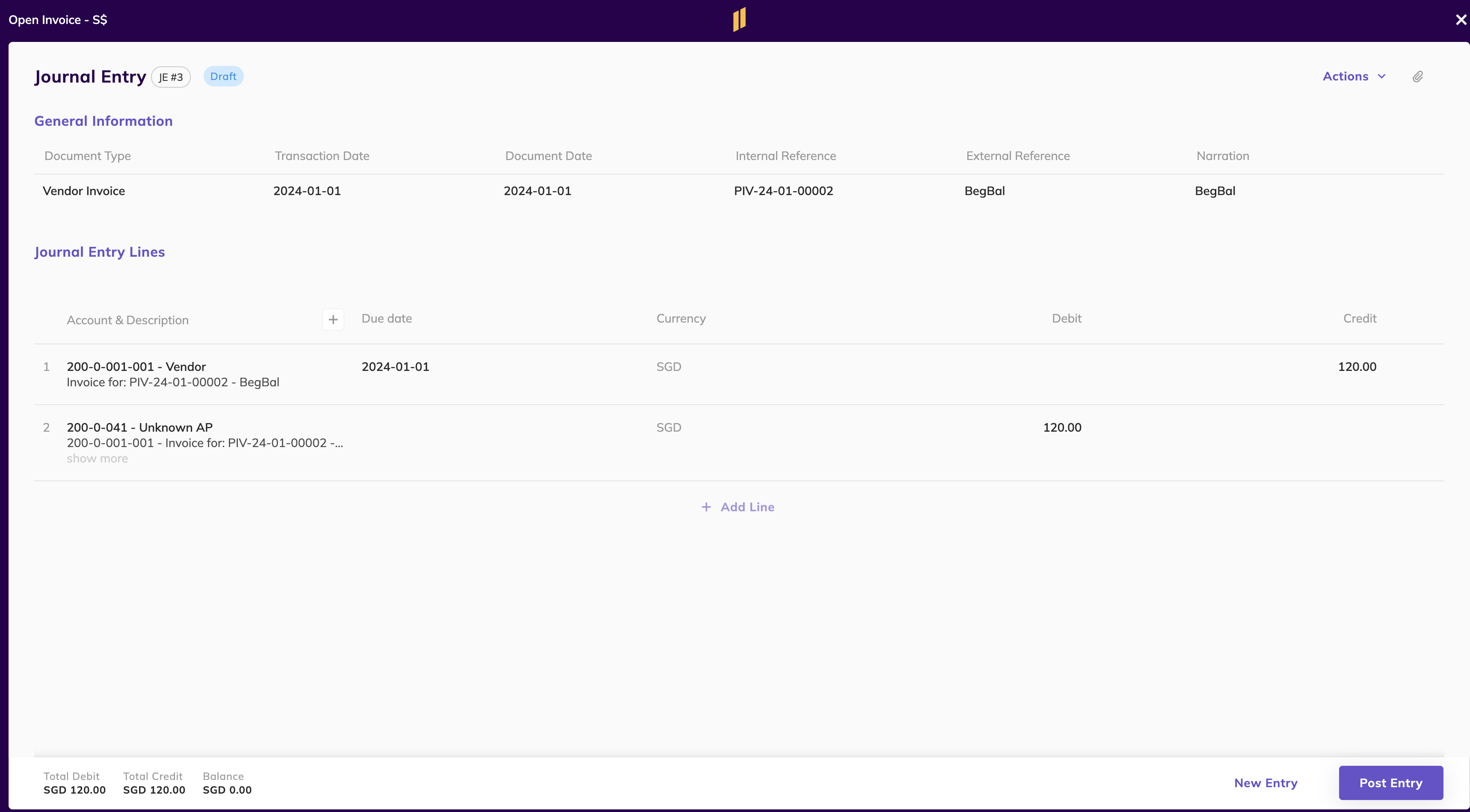

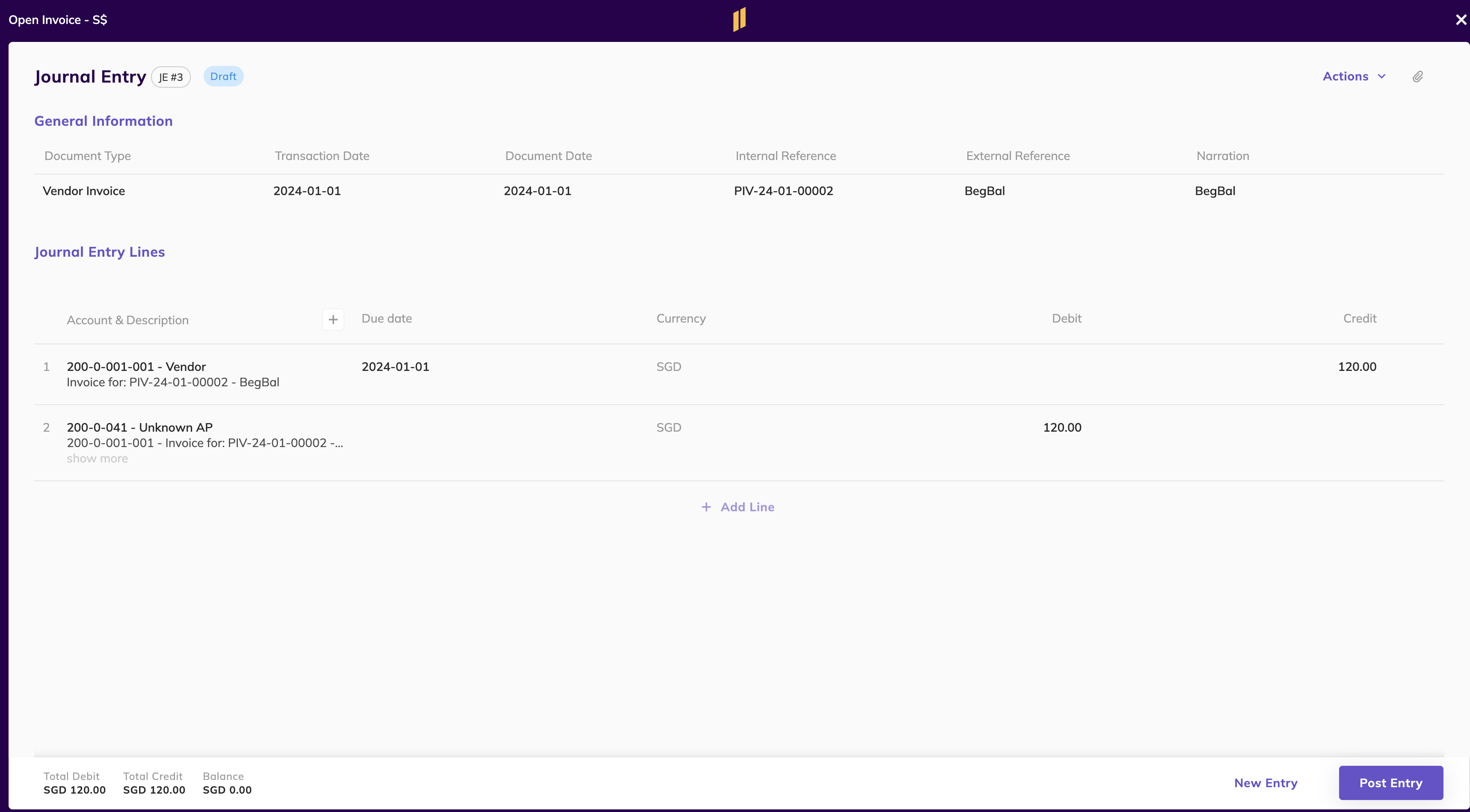

Here is a sample of how the Invoice would look like for an Open Vendor Invoice

Here is what the JE would look like upon posting

💡 Repeat step 2 for each outstanding legacy invoice.

Step 4: Match the Transactions in the GL

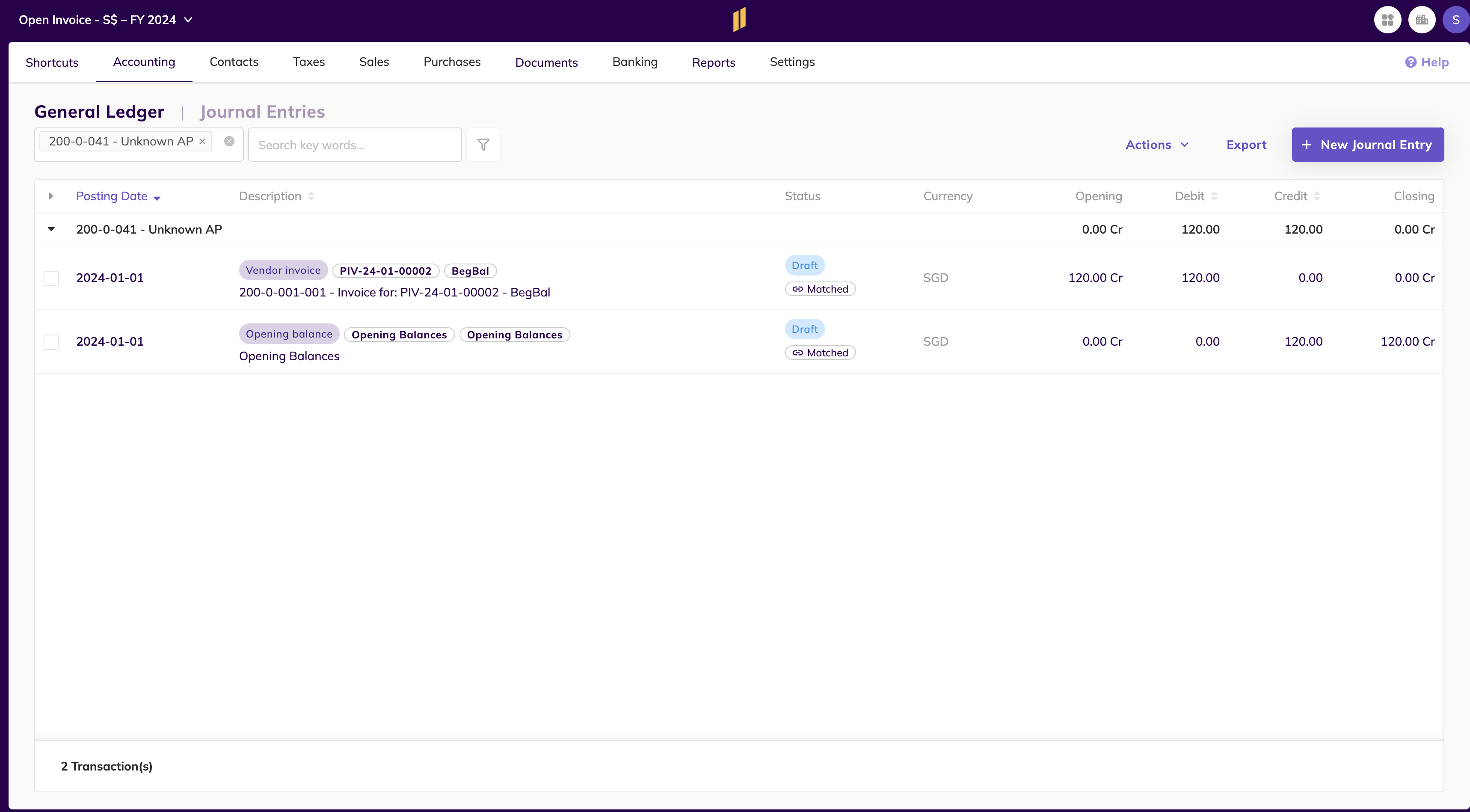

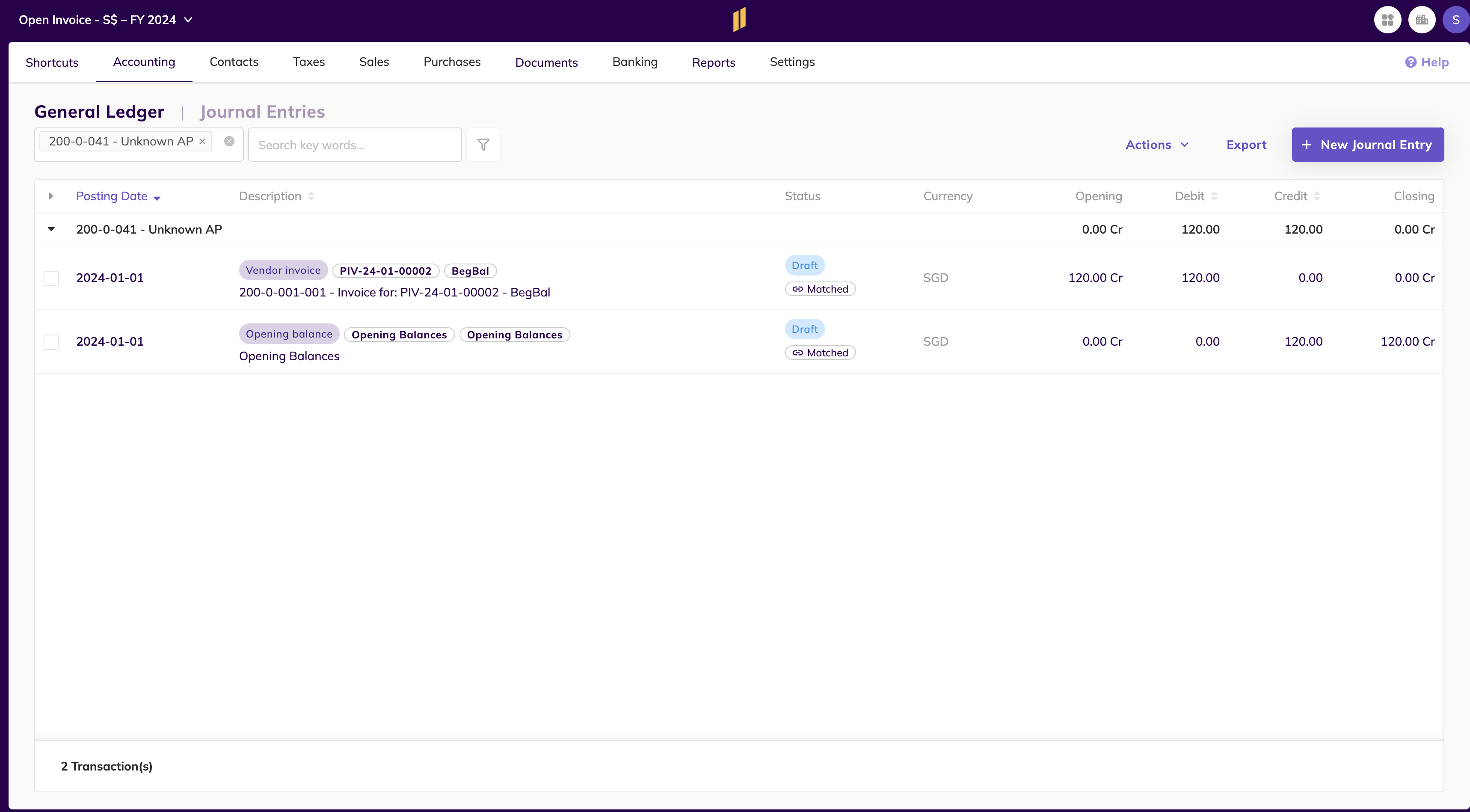

Go to the General Ledger and verify that your Unknown AR and Unknown AP accounts are balanced. If unbalanced, it means that you are missing some open invoices. If Balanced, you can match the entries.

Here is the example for Unknown AP:

Generating Carry Forward

- Go to Manage my companies at the top right corner..

- Click on the ellipses of the Fiscal year you want to generate the carry forward, and from the menu select Carry Forward.

- Select the account the carry forward should be generated with and click on Create Entry.

Note: Carry Forward entry will be automatically generated again and updated when the previous FY is closed.

Closing a Fiscal Year and Generating Carry Forward in New Fiscal Year

- Go to Manage my companies at the top right corner..

- Click on the ellipses and from the menu, select Manage fiscal calendar.

- Click on the ellipses of the Fiscal year you want to close, and from the menu select Close Fiscal Year.

- Complete the missing information and click on Close Fiscal Year.

- Click on New Fiscal Year to create a new fiscal year.

- Click on the ellipses of the Fiscal year you want to generate the carry forward, and from the menu select Carry Forward.

Note: Closed Fiscal Year cannot be reopened. A close FY will have all its entries in Read Only. Only proceed to close a Fiscal Year if you have submitted the final Financial Reports.

Article Information

✍🏻 Written by: Eleven Support Team

🔎 Reviewed by: Noe Saglio

🗓️ Last Updated: November 12, 2025